Towards Clearer Waters: CFTC GMAC Subcommittee's Recommendations for Digital Asset Taxonomy

We highlight the impact of the Subcommittee's recommendations on regulatory clarity and subsequent challenges for the digital assets space.

Clarifying Terminology for Innovation and Regulation:

As regulators worldwide grapple with the complexities of the evolving digital assets landscape, the US Commodities and Futures Commission's (CFTC) Global Markets Advisory Council (GMAC) for Digital Asset Markets (DAM) Subcommittee (hereinafer referred to as the “Subcommittee”) took a step forward by releasing a comprehensive set of recommendations on Digital Asset Classification and Taxonomy on March 6, signifying a concerted effort from a US regulator to bring clarity and structure to the space.

At the heart of the recommendations lies a fundamental acknowledgment of the need for consistent terminology—a language that not only facilitates effective regulatory oversight but also fosters innovation. This approach reflects the agency’s attempt at a more proactive stance on regulatory governance to create an environment conducive to market development. By advocating for a consensus-driven and functional taxonomy, the recommendations aim to lay the groundwork for a robust framework flexible enough to adapt to the evolving nature of digital assets. The Subcommittee also emphasizes on a jurisdictionally agnostic approach which underscores the importance of inclusivity to ensure regulatory frameworks remain relevant across geographical contexts.

Enhancing coherence in language would ultimately enable regulators to synchronize their understanding and tackle unique challenges posed by the technology. This, in turn, would enable the drafting of tech-informed regulations, promoting investor confidence and upholding market integrity.

Defining Digital Assets:

The recommendations define a Digital Asset (DA) as a:

“Controllable Electronic Record, where one or more parties can exercise control through transfer of this record and where such record is uniquely identifiable.”

However, the definition explicitly excludes Controllable Electronic Records (CERs) that solely serve as part of the financial institution records, highlighting the Subcommittee’s intent to segregate the digital asset ecosystem and its interplay from the traditional financial infrastructure.

Key Features for Classification:

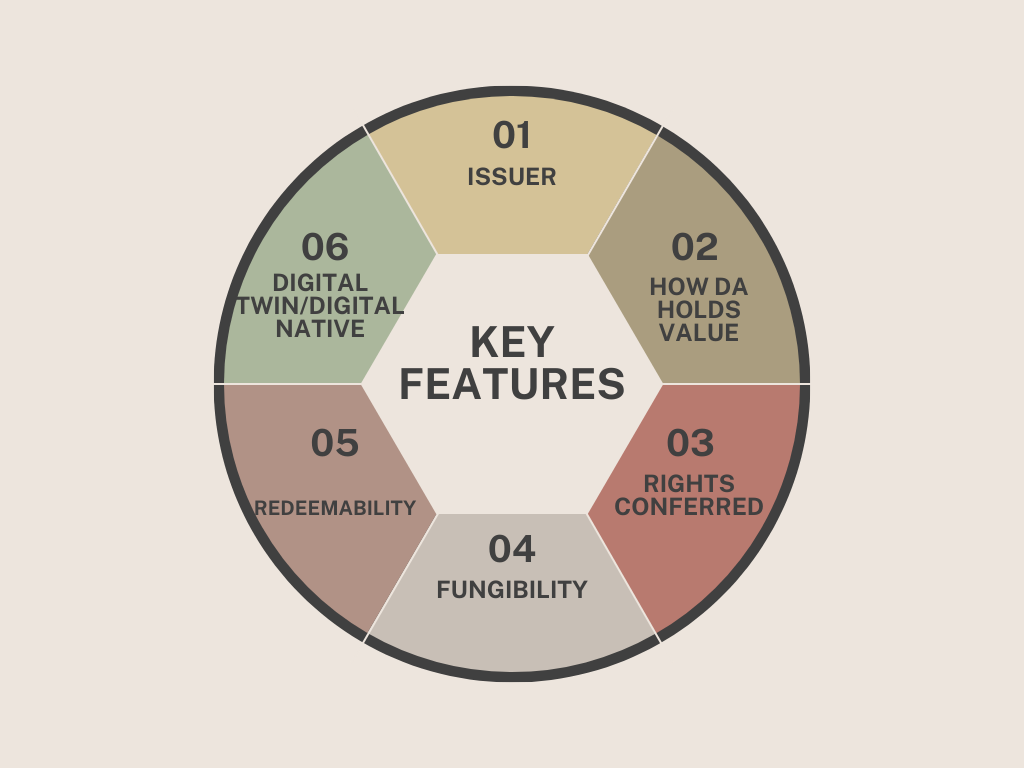

To facilitate classification, the recommendations identify key features that serve as foundational elements for understanding digital assets. These features include, but are not limited to - issuer of the digital asset, the mechanism of how the digital asset holds value, rights conferred by the digital asset, fungibility, redeemability, and the nature of the record. The recommendations emphasize the potential existence of additional attributes influencing digital asset classification, including their use cases and functionalities. The features outlined in the recommendations offer insights into the characteristics of digital assets and it becomes essential to recognize their inherent complexity and the need for nuanced analysis.

Issuer: The issuer is the entity responsible for issuing the digital asset or on behalf of whom a service provider issues it. It represents the foundation of the asset's legitimacy and accountability. While some digital assets have identifiable issuers, the Subcommittee acknowledges that certain digital assets may exist without a central issuing entity, as a challenging factor to how traditional notions of ownership and control are regulated.

Mechanism Underpinning Asset Value: This feature delineates how the value of a digital asset is determined. Pegged assets have their market price tied to the value of another asset, such as a fiat currency or a basket of commodities. Conversely, unpegged assets have a free-floating value, dictated by market supply and demand dynamics.

Rights Conferred: It elucidates the legal entitlements or claims that controllers of digital assets possess against the issuer (if any). These rights establish the framework for enforceable claims, representing the contractual obligations and privileges associated with digital asset ownership.

Fungibility: Fungibility refers to the interchangeability of units within a digital asset. Fungible assets are mutually interchangeable on a like-for-like basis, whereas non-fungible assets possess unique or distinct characteristics.

Redeemability: Redeemability pertains to whether a digital asset can be redeemed for its underlying value or equivalent assets. Redeemable assets, such as fixed-income financial digital assets or tokenized securities, offer holders the opportunity to realize their investment at maturity. Non-redeemable assets, on the other hand, lack an issuer or mechanism for redemption.

Nature of Record: This feature outlines the underlying nature of the digital asset's record-keeping system. A Digital Twin record represents assets immobilized on another system of record, ensuring accurate ownership reflection through a reconciliation processes. In contrast, a Digital Native record serves as a primary record of value, independent of external reconciliation requirements. However, certain tokenized arrangements (Eg. fractionalized security interests) may deviate from these classifications and would further necessitate a more detailed understanding of their operational dynamics.

Digital Assets Classification Categories:

1. Money or Money-Like:

This category encompasses digital assets that exhibit specific characteristics indicative of money or money-like instruments, such as reliability as a store of value, medium of exchange, or unit of account. Central Bank Digital Currency (CBDC), which can be either general purpose or wholesale, bank deposits (tokenized bank deposits and deposit tokens), reserve-backed digital currencies, and stablecoins fall within this category.

The inclusion of stablecoins within the money-like digital assets category reflects an appreciation for the digital asset class and its potential role within the financial ecosystem. Stablecoins, as seen by their many use cases, are already valuable tools for facilitating cross-border transactions and mitigating volatility risks. By classifying its unique attributes under such classification, regulators can better tailor their regulatory approach to address potential risks in this burgeoning sector.

The classification however isn't without its nuances - specifically, it states that reserves backing stablecoins must comprise cash and/or high-quality liquid assets (HQLA). Any stablecoin relying on higher-risk assets in its reserve would be categorized as an 'other cryptoasset' (defined below). However, if a stablecoin's structure ensures sufficient ringfencing, it might also qualify as a tokenized alternative asset falling under the category of an Alternative Digital Asset (defined below). The intent is to ensure that even during issuer-specific stress or market downturns, the issuer can redeem stablecoin holders. Consequently, current algorithmic stablecoins would fail to meet these conditions and not be recognized as stablecoins under this classification. Interestingly, for Tether (USDT), the world's largest stablecoin by market capitalization, to fit squarely within the stablecoin definition, the company must conduct and provide evidence through an audit that USDT is indeed backed by qualifying assets, as it claims.

2. Financial Digital Assets:

Financial digital assets encompass a diverse array of regulated instruments that may be subject to varying regulatory treatments across jurisdictions. While traditional derivative contracts providing exposure to underlying digital assets are excluded from this category, the focus remains on securities and derivatives. Securities and derivatives are further classified into tokenized securities and security tokens, and tokenized derivatives and derivative tokens respectively.

Tokenized securities and tokenized derivatives, represented as digital twin tokens, encapsulate underlying securities, financial instruments or derivative instruments issued on alternative platforms, meeting the requisite definitions under local law. Conversely, security tokens and derivative tokens, represented as digital native tokens, also adhere to security, financial instrument or derivative instrument definitions under local law, offering a more native digital representation of traditional securities and derivative contracts respctively.

3. Alternative Digital Assets:

Tokenized alternative assets represent interests, entitlements, or claims on non-security assets or the issuing entity, fulfilling legal definitions within local laws. Examples range from tokenized physical commodities to real estate. Notably, certain activities, such as fractionalization, may prompt a reclassification of tokenized non-financial assets, potentially shifting their designation from alternative digital assets to financial digital assets.

4. Cryptoassets:

Within this category, the recommendations delineate between ‘platform cryptoassets’ and ‘other cryptoassets’, each serving distinct functions. According to the Subcommittee, platform cryptoassets are distinguished by their non-redeemable nature and inherent cryptographic functionalities. These digitally native tokens lack direct rights against the issuer and often possess exchange value within specified parameters. They are integrally tied to an underlying platform, serving a crucial role in incentivizing and securing network or application infrastructure. A defining characteristic of platform cryptoassets is their obligation to fulfill one or both of the following functions, i.e., providing cryptographic economic incentives for network maintenance and security, and/or serving as a universal medium of exchange within the underlying network infrastructure. Conversely, other cryptoassets are defined as those that are primarily used as speculative investments, lacking redeemability or rights conferred against issuers.This approach allows for the drafting of regulations that cater to cryptoassets with genuine utility, while also addressing the unique risks associated with speculative assets like meme coins.

5. Functional Digital Assets:

As per the recommendations, functional digital assets provide governance or access to specific infrastructures or applications within the digital ecosystem. Examples include tokens granting governance rights or decision-making authority within decentralized autonomous organizations (DAOs) or access to decentralized applications (DApps). These assets represent the paradigm shift in ownership and participation, that have empowered stakeholders and democratized access to digital platforms and services.

6. Settlement CERs:

Serving as digital tokens used solely for ownership transfer or financial functions, settlement CERs facilitate transactions and record ownership or perform other middle/back-office financial functions. Therefore, settlement CERs are not considered to be digital assets because they exist temporarily and mostly used for record-keeping purposes.

Comparison with the EU's MiCA Regulations:

The alignment of taxonomies between the Subcommittee’s recommendations and the European Union's bespoke regime under the Markets in Crypto-Assets Regulations (MiCA) holds substantial promise, with a view of offering a more coherent regulatory framework that is in tune with each other. The exact definitions of crypto-assets diverge slightly between the two frameworks, whereby MiCA provides a broader definition which is further subdivided on a more granular basis into e-money tokens, asset-referenced tokens etc. while the Subcommittee focuses on the subdivision of assets into 'platform crypto assets' and 'other cryptoassets' only. The Subcommittee emphasizes the control and transferability of tokens, whereas MiCA focuses on the substance of the asset and what it represents. Despite these differences in approach, both frameworks aim to address the unique risks associated with digital assets and ensure a level playing field for market participants.

In terms of further similarities, both the Subcommittee’s recommendations and MiCA advocate for the regulation of stablecoins when utilized as a medium of exchange to be done within the banking system. They also have concurring views on how to define security tokens and tokens that are native to a platform. There is further alignment in defining tokens not pegged to the value of other assets, described as "Functional Digital Assets" by the Subcommittee. However, the Subcommittee states that the ownership of these digital assets could provide the holder with claims to future revenue, which might further give rise to potential issues regarding the ownership as to their classification as securities.

There are also some noticeable differences that arise in both frameworks - with reference to the classification of stablecoins pegged to other assets, the Subcommittee focuses on the substance of the token as payments, while MiCA references these as Asset Referenced Stablecoins (ARTs). This discrepancy may impact the prudential treatment of assets and affect business models differently in the US and the EU.

NFTs are also not extensively addressed in either framework, with the Subcommittee’s recommendations only differentiating based on fungibility. This ambiguity may require additional attention in the any upcoming guidance issued either side of the Atlantic.

Conclusion:

The Subcommittee’s recommendations on Digital Asset Classification and Taxonomy represent a significant step toward achieving regulatory clarity. By offering clear definitions, identifying key features, and categorizing digital assets, these recommendations provide valuable insights for regulators, market participants, and investors alike. However, while the Subcommittee’s recommendations signal progress, some challenges are likely to persist in their practical implementation and adaptation to the dynamic digital asset environment.

A notable challenge arises from the ongoing jurisdictional debate between the CFTC and the U.S. Securities Exchange Commission (SEC) regarding the appropriate regulatory authority for digital assets. This disagreement may result in divergent views on how digital assets should be classified and which key features should be considered, particularly from the perspective of securities regulation. The SEC’s tendency to view most cryptoassets (except Bitcoin) as securities could potentially lead to disagreements with the Subcommittee's classifications and further complicate regulatory oversight and enforcement efforts. To this end, the Subcommittee’s taxonomy demonstrates its flexibility to accommodate future developments in the digital asset space, reflecting a commitment to providing clearer upfront guidance beyond the SEC’s piecemeal approach of analyzing each digital asset's security status on a case-by-case basis.